tax bracket 2018|2018 tax rate schedule : Clark Documentary Requirements. Certificate of Income Tax Withheld on Compensation ( BIR Form 2316 ), if applicable. Certificate of Income Payments Not Subjected to Withholding .

CCIS ANL fournit des services dans son dépôt de 51 000 m² pour les conteneurs vides, ainsi que la maintenance et la réparation. . Service Commercial +61 3 8842 5730. Service Commercial.

[email protected]. A propos de CCIS ANL. CCIS ANL Australia est un parc à conteneurs vides basé à Melbourne, spécialisé dans le stockage, la .

PH0 · taxes 2018 for f1 federal table

PH1 · tax brackets 2018 vs 2019

PH2 · tax brackets 2018 uk

PH3 · irs tax table 2018 pdf

PH4 · individual irs tax rates 2018

PH5 · Iba pa

PH6 · 2018 tax rate schedule

PH7 · 2018 tax brackets vs 2020

PH8 · 2018 tax brackets chart

Log in to My.SSS Portal and access the online services of the Republic of the Philippines Social Security System. Manage your records, benefits, contributions, and more.

tax bracket 2018*******Take note that what we’re using are the tax tables from 2018-2022 since we’re still computing the tax due of the employee for the year 2022. To explain in detail, if the employee’s taxable income is P300,000 , this will fall under the income bracket “Above P250,000 to P400,000”. Tingnan ang higit pa2018 tax rate scheduleWhat are the important points related to the new income tax rates from 2023 and in succeeding years? From year 2023 onwards, the income tax rates under TRAIN will . Tingnan ang higit patax bracket 2018 2018 tax rate scheduleWhat are the important points related to the new income tax rates from 2023 and in succeeding years? From year 2023 onwards, the income tax rates under TRAIN will . Tingnan ang higit pa

What changed in the new TRAIN tax law versus the old income tax law? Prior to the approval and implementation of the TRAIN law in 2018, the following tax tables were in use until . Tingnan ang higit paHow to compute income taxes under the new TRAIN law? The formula to follow is simple. The formula that can be used to compute . Tingnan ang higit paThe first part of the approved TRAIN tax reform law, implemented from 2018 until 2022, adopted major changes from the then existing Philippine taxation system, as follows: The updated TRAIN tax rates are as follows. Again, these rates only governed . Tingnan ang higit paDocumentary Requirements. Certificate of Income Tax Withheld on Compensation ( BIR Form 2316 ), if applicable. Certificate of Income Payments Not Subjected to Withholding .

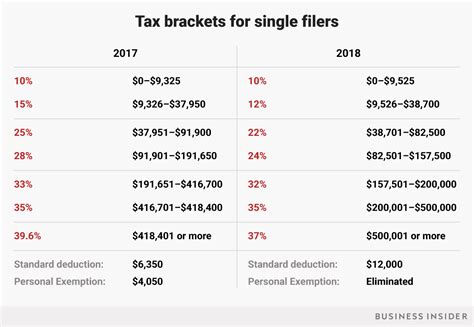

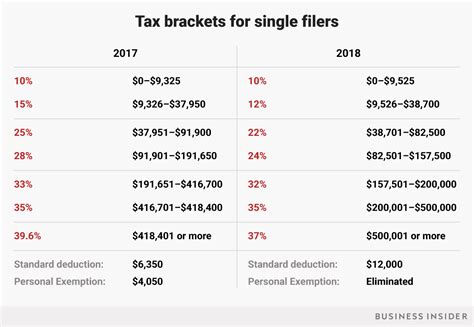

Find out the income tax brackets, rates, standard deduction, personal exemption, and other tax provisions for 2018. See how the Tax Cuts and Jobs Act .

For 2018 taxes, taxpayers fell into one of seven brackets, depending on their taxable income: 10%, 12%, 22%, 24%, 32%, 35% or 37%. Thanks to an overhaul of the federal tax code, there are new income tax brackets and rates for 2018. Whether you’re filing single, married filing jointly, or a head of household, here’s how.There are two sets for the new BIR Income Tax Rates and Tax Table for 2018: 1. Income Tax Tables to be implemented and summarized for the years 2018 – 2022 under the . Medicare levy surcharge income, thresholds and rates. Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income .

2018 Federal Income Tax Brackets. Find out your 2018 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of . In 2018, the brackets dropped to 10%, 12%, 22%, 24%, 32%, 35%, and 37%. As currently legislated, taxpayers can expect to be in a higher marginal tax bracket, .Example. Imagine that there are three tax brackets: 10%, 20%, and 30%. The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to .

Income Tax Brackets and Rates. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For .2018 tax brackets. As of 1 January 2018, the tax brackets have been updated due to the passage of the Tax Cuts and Jobs Act: Marginal tax rate Single Married filing jointly 10% Up to $9,525: Up to $19,050 12% $9,526 to $38,700: $19,051 to $77,400 22% $38,701 to $82,500: $77,401 to $165,000 24%tax bracket 2018 In 2023 and 2024, there are seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Taxable income and filing status determine which federal tax rates apply to you .Personal Allowance in Canada for 2018. Amount: As of 2018, the basic personal amount in Canada is set at $ 11,809.00. This amount is adjusted annually to account for inflation and other economic factors. Calculation: To calculate the tax credit, this amount is multiplied by the lowest Federal tax rate. In Canada, the lowest rate is 15%, making .

Income Tax Rate (Year 2018-2022) P250,000 and below: 0%: Above P250,000 to P400,000: 20% of the excess over P250,000: . 2) taxable income threshold per bracket has been adjusted upwards; 3) tax rate charged on each taxable income bracket was revised, mostly lowered; 4) annual gross income eligible for tax exemption .In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $500,000 and higher for single filers and $600,000 and higher for married couples filing jointly. TABLE 1. Tax Brackets .

The standard deduction in 2018 as the law currently exists is $13,000 for a couple filing jointly. That number will jump to $24,000. For single filers it jumps from $6,500 to $12,000. The personal . The standard deduction in 2018 as the law currently exists is $13,000 for a couple filing jointly. That number will jump to $24,000. For single filers it jumps from $6,500 to $12,000. The personal .

Rental property income. Credits, deductions and income reported on other forms or schedules. Use our Tax Bracket Calculator to understand what tax bracket you're in for your 2023-2024 federal income taxes. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.

In unserem Beta-Motor-Shop findet ihr verschiedene Zubehörteile sowie Beta Ersatzteile für eure Enduro. Selbstverständlich können wir auch nicht im Shop gelistete Ersatzteile für alle Beta Enduros beschaffen. Bitte hierzu die Möglichkeit des Beta-Parts-Finder nutzen um die richtige Teilenummer zu finden und uns per E-Mail mitzuteilen.

tax bracket 2018|2018 tax rate schedule